Medicaid in the Crosshairs

The GOP is talking about our debt and deficit while taking a chainsaw to the federal budget to find a way to pay for tax cuts. Medicaid is large and largely misunderstood putting it the line of fire.

Republicans are talking about our debt and deficit while taking a chainsaw to the federal budget to find money… to pay for tax cuts.

Make It Someone Else’s Problem

Medicaid and SNAP benefits have been in the crosshairs since the start. The latest plan they have to offer is simply moving the financial liability to the states.

It’s an idea so horrible that even some republicans disown it. States would likely be forced to increase taxes and reduce benefits. In the long run, the net effect would harm everyone in terms of health and/or financial outcomes.

Punish Everyone Because Someone is Guilty

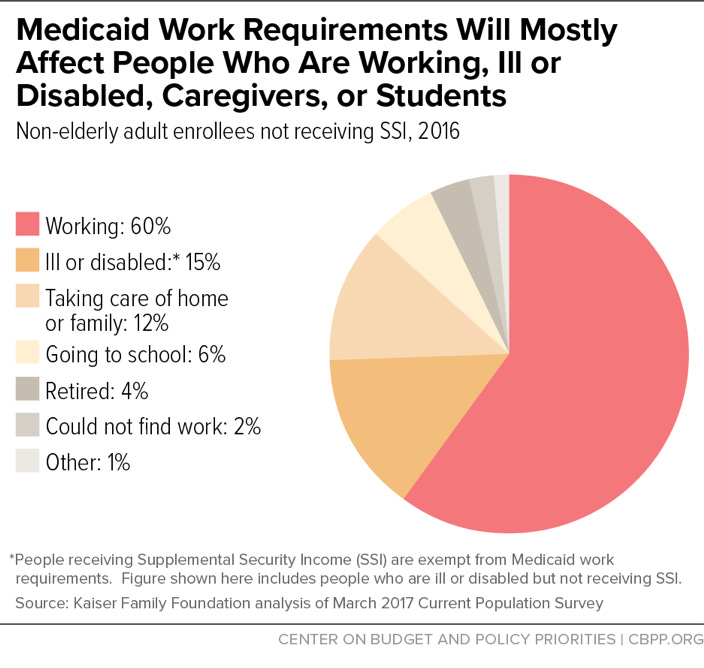

A less unpopular scheme they are pushing is work requirements. Everyone feels a sense of injustice at paying taxes to benefit someone who could do more to help themselves. The truth is we can never eliminate fraud, and the more we try to prevent it, the more likely we are to punish innocents who deserve help. We need to find some balance. The moral imperative is to protect the innocent more than punish the guilty. This is the same millennia-old principle behind due process in our legal system and the concept of innocent until proven guilty.

Keeping that in mind, we have to understand that Medicaid work requirements will mainly affect people who are either already working or are otherwise morally justified in receiving assistance.

Your underemployed relative with diabetes.

Your high school friend who struggles with mental health issues

Your disabled neighbor who had to retire early.

Someone fired from their job having a hard time finding a new one.

Someone having a hard time navigating the system.

Someone whose application was denied due to an administrative error.

You may be saying you don’t know anyone who fits these descriptions. That may not be true. Given the stigma around it, not many people brag about being a recipient of welfare services.

It Wouldn’t Affect Me, Right?

You don’t get Medicaid, and you don’t think you know anyone who does, so how does this impact you beyond how your tax dollars are spent? More than you would imagine.

Increased Medicaid funding has positive effects on the health care system overall.

It has been linked to greater access to health care in general due to the increased money that goes to providers. The flip side is that when people don’t have insurance, they skip preventative care and often wait until they need emergency care for acute problems. These higher cost bills frequently go unpaid by the patients, leaving health care providers to cover their costs by increasing prices for everyone.

These factors are especially true in rural areas with limited access to health care.

What Should We Do?

Good question. There are multiple goals we could address here, choose your own adventure. (← For a good time, click here)

You want to save money and improve outcomes?

Look at more public health care. Pooled purchasing power lowers administrative overhead and gives more power to negotiate pricing. Administrative costs represent about 7.6% of overall health spending in the U.S. compared to 3.8% on average in comparable countries. It’s a no-brainer, especially given the gig working economy and extensive use of outsourcing labor, which lowers employers' price negotiation power.

At the same time, insurers and related health administration have become bigger, fewer in number, and more complex. Now, entirely new types of companies, like PBMs, partner with insurers to figure out how to soak up more of our health care dollars.

You want people to work and get off Medicaid?

Combine work requirements with programs to help people deal with the problems preventing them from working. CareSource’s JobConnect program, with 2300 enrollees, has helped 800 people find jobs in the last few years. The University of Pittsburgh Medical Center has provided training and support services to those enrolled in its Medicaid program. The Medical Center has hired over 10,000 enrollees into full-time jobs with health benefits.

You want to work on the debt and deficit?

Back to the original excuse to look at Medicaid, the national debt and deficit, combined with the actual reason, tax cuts for the rich.

Look at Biden’s plan for the tax extension, which extends the cuts for middle and lower income earners, paying for it by increasing taxes on corporations and the wealthy. It’s not rocket science. Even if it was, there are plenty of rocket scientists around; we can figure this out.

References:

https://www.npr.org/sections/shots-health-news/2025/04/15/nx-s1-5361491/medicaid-work-requirements

https://www.cbpp.org/research/health/medicaid-work-requirements-will-reduce-low-income-families-access-to-care-and-worsen

https://bidenwhitehouse.archives.gov/briefing-room/statements-releases/2024/03/11/fact-sheet-the-presidents-budget-cuts-taxes-for-working-families-and-makes-big-corporations-and-the-wealthy-pay-their-fair-share/

https://www.npr.org/sections/shots-health-news/2025/04/15/nx-s1-5361491/medicaid-work-requirements

https://www.kff.org/report-section/the-effects-of-medicaid-expansion-under-the-aca-updated-findings-from-a-literature-review-report/

https://www.aha.org/fact-sheets/2025-02-07-fact-sheet-medicaid-hospital-payment-basics

https://www.ruralhealth.us/blogs/2025/04/critical-condition-how-medicaid-cuts-would-reshape-rural-health-care-landscapes

https://www.kff.org/medicaid/issue-brief/medicaid-what-to-watch-in-2025/